Fake Insurance Document, In recent years, the prevalence of fraudulent activities in various industries has increased, and the insurance sector is no exception. One of the most concerning forms of fraud is the creation and use of fake insurance documents. These forged documents not only put the perpetrators at risk but also harm innocent people and organizations that unknowingly rely on them. This article will explore the dangers and consequences of fake insurance documents, how to spot them, and the legal repercussions for those involved.

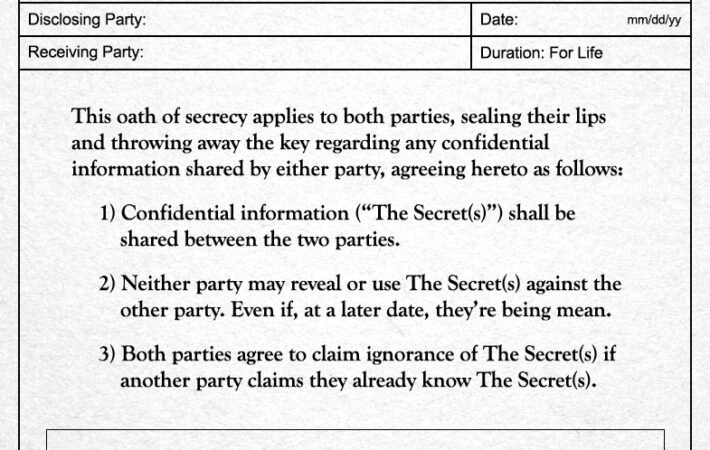

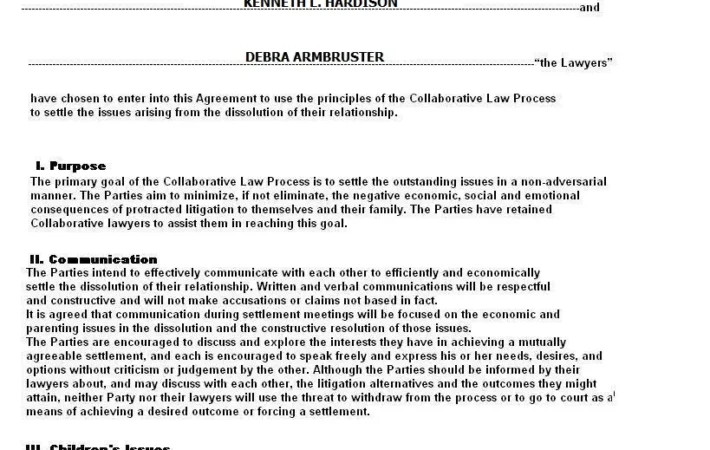

What Are Fake Insurance Documents?

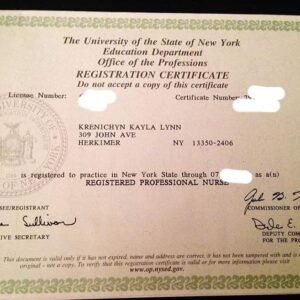

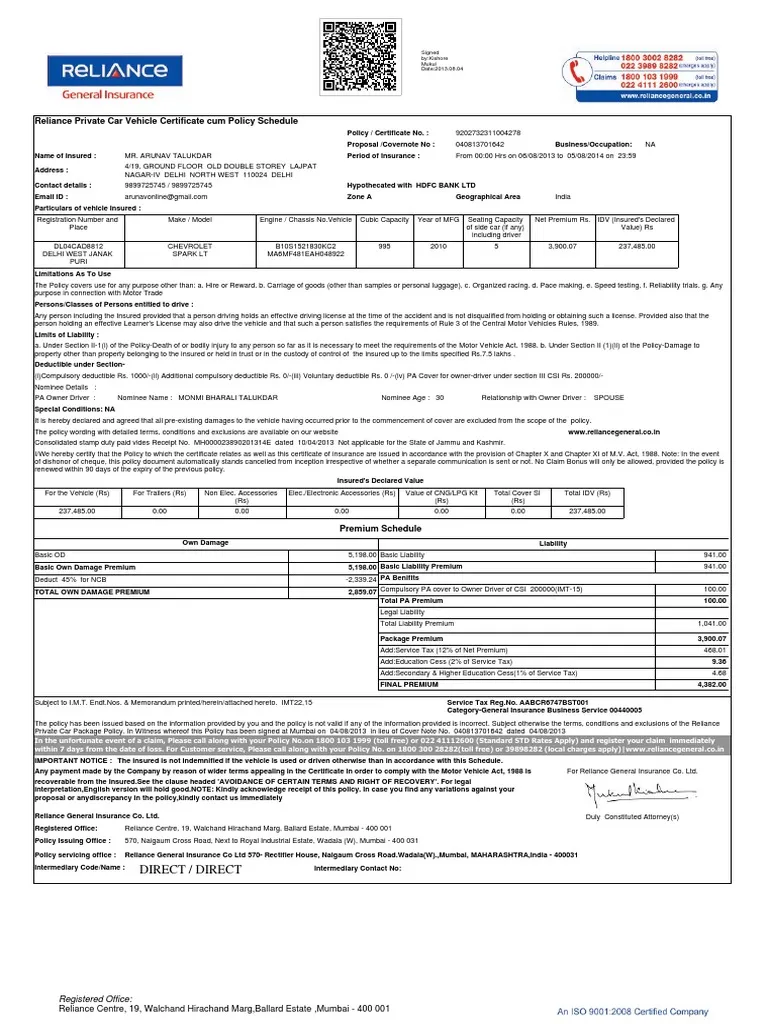

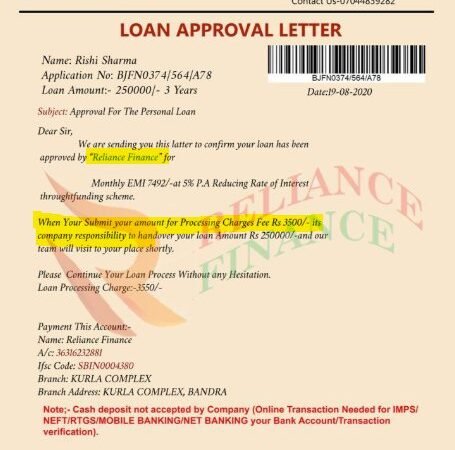

Fake insurance documents are counterfeit papers that falsely represent an individual or company’s insurance coverage. These documents may include fake insurance policies, fake claims forms, or forged certificates of insurance. The purpose of these fraudulent documents is to deceive others into believing that a legitimate insurance policy exists when, in fact, it does not.

Common scenarios involving fake insurance documents include individuals or businesses attempting to avoid the costs of legitimate insurance, attempting to defraud insurance companies, or using false documents to appear insured when they are not. Some fraudsters may even create entirely fake policies to gain access to a supposed coverage benefit.

The Dangers of Fake Insurance Documents

- Financial Losses

One of the most significant dangers of fake insurance documents is the potential for financial loss. Individuals or businesses relying on these fraudulent documents are at risk of not being protected in the event of an accident or other covered event. For example, if someone were to drive with a fake car insurance document, they may believe they are protected in case of an accident, but in reality, they have no coverage. This could lead to devastating financial consequences, including legal fees, medical expenses, and damage repair costs that would otherwise be covered by legitimate insurance. - Damage to Reputation

Companies and individuals found to be using or involved with fake insurance documents risk significant reputational damage. Businesses that engage in fraudulent activities can lose customer trust, leading to loss of clientele and even legal repercussions. In a world where trust is crucial, this kind of reputation damage can be almost impossible to recover from. - Legal Consequences

Creating or using fake insurance documents is a criminal offense in many countries. Depending on the severity of the fraud and the laws in place, perpetrators could face hefty fines, jail time, or both. Insurance fraud is treated as a serious crime, and individuals caught using fake documents could be prosecuted for forgery, fraud, and conspiracy. These legal consequences are not only costly but can also have a lasting impact on an individual’s or a company’s future. - Increased Insurance Costs for All

When fake insurance documents are used, they can also contribute to increased premiums for everyone. Insurance companies may raise premiums for honest customers to account for the losses caused by fraudulent claims. This has a ripple effect, where innocent individuals or businesses end up paying higher premiums because of the fraud committed by others.

How to Spot Fake Insurance Documents

Detecting fake insurance documents can sometimes be difficult, but there are several red flags to watch out for:

- Inconsistent or Unprofessional Formatting

Legitimate insurance documents typically follow a professional format and adhere to industry standards. If the document looks unprofessional, contains spelling errors, or has irregular fonts, it may be a red flag. - Lack of Contact Information

Most legitimate insurance documents will provide detailed contact information for the insurance company, including phone numbers, emails, and physical addresses. A lack of contact details or incorrect information should be investigated further. - Missing or Altered Policy Numbers

Check the policy number on the insurance document. Insurance policies usually have a unique policy number. If the number seems to be missing or if it doesn’t match the issuing company’s standard format, the document could be fake. - Inconsistent Dates

Check the dates on the policy. Fake documents often contain incorrect or inconsistent dates that don’t align with the coverage period or the time the policy was supposedly issued. - Verify with the Insurance Provider

The most effective way to ensure that an insurance document is legitimate is to directly contact the insurance provider. Cross-check the policy number and details with the insurer to verify the authenticity of the document.

The Legal Repercussions of Using Fake Insurance Documents

Using fake insurance documents is illegal in most jurisdictions. Those found guilty of creating, distributing, or using fake insurance documents can face a variety of penalties, including:

- Fines: Depending on the extent of the fraud, the fines can range from hundreds to millions of dollars.

- Jail Time: Insurance fraud is often classified as a criminal offense, with sentences of several years in prison for those convicted.

- Civil Suits: Individuals or companies who suffer losses due to the use of fake insurance documents may sue the perpetrators for damages.

- Loss of Professional Licenses: Professionals who engage in insurance fraud may lose their licenses, making it difficult for them to work in their industry again.

Conclusion

The use of fake insurance documents is not just a financial risk but a criminal act with far-reaching consequences. Individuals and businesses involved in such fraudulent activities not only risk significant legal penalties but also endanger their reputation and the financial well-being of others. It is crucial to be aware of the signs of fake documents and take steps to verify the authenticity of any insurance document you encounter. Whether you are an individual seeking insurance or a business conducting due diligence, taking the time to ensure that insurance documents are genuine can save you from costly and damaging consequences.

You Might Also Like These:

Leave a comment

Your email address will not be published. Required fields are marked *